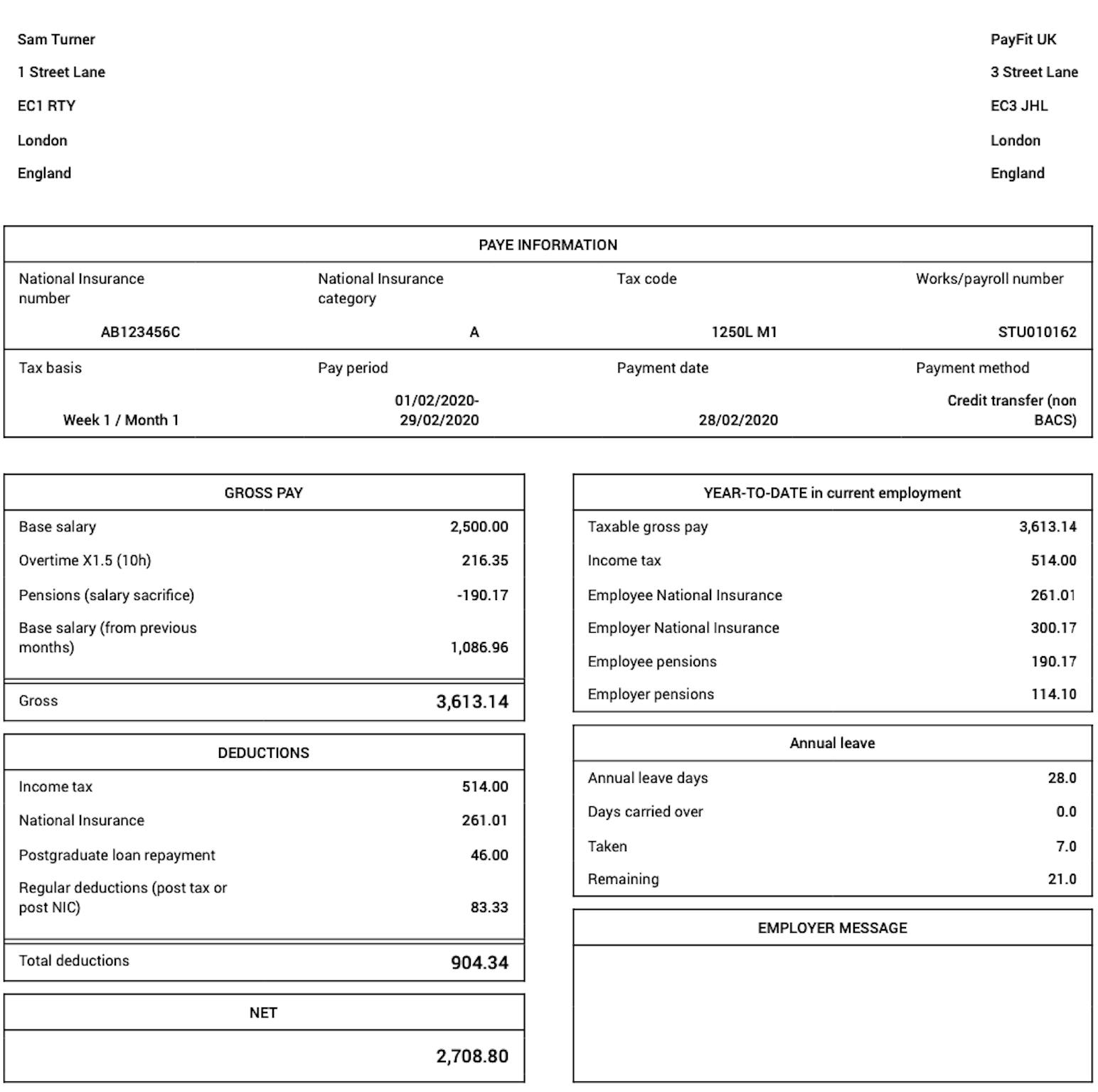

- Statements

Financial pricing increase to 23-seasons large

Dave Ramsey and you can a section off financial specialists join ‘FOX & Friends’ to express advice for Us citizens trying to get homes and you will approaches for holiday believed.

Since many years-high financial costs shake-up the genuine estate land, fiscal experts into the Ramsey Choice group has actually given advice for homeowners in order to browse the fresh new volatile business.

“When you find yourself off financial obligation and you’ve got their emergency finance, prices aren’t going to wade everywhere however, upwards, despite interest levels increasing,” Ramsey Choices maker Dave Ramsey said into a “Fox & Friends” panel Monday. “So if you rating an interest rate you never like, your definitely normally re-finance later on and then have right back out of it. Nevertheless housing marketplace merely stalled.”

“And you can people, i had Bloody Weekend toward figuratively speaking throwing into Week-end, and Christmas is results down on you,” the guy continued, “and therefore it is the right time to get on a resources and you may log in to an idea.”

The typical speed toward benchmark 30-seasons home loan achieved their highest height since 12 months 2000, broadening off 7.19% the other day so you’re able to eight.31% recently, according to the most recent studies by Freddie Mac computer.

A monetary pro committee having Ramsey Alternatives personalities spotlighted the benefits out of cost management towards the “Fox & Friends” Monday in the course of ages-high mortgage costs and you may festive season expenses. (Fox Development)

“When you’re a good millennial, you happen to be Gen Z, you will be hopeless nowadays. You feel cynical,” “The fresh Ramsey Show” co-servers George Kamel and told you Saturday. “And so i want to give them specific pledge that it’s you’ll be able to for them, however surely got to store this new FOMO since your mothers assert, ‘You’re throwing away money on book, get a property, rating a property, get a property,’ and you’re broke.”

“And so there is to have some patience because the book and you may mortgages aren’t apples to apples,” Kamel additional. “You have fees, you really have insurance policies, HOA, PMI, this new emails embark on. Thus in advance of you’re going to get property, ensure that your personal debt totally free that have a crisis funds. We want you to definitely become a resident, we do not require one to the home of very own your.”

The median home sales price was $374,975 for the four weeks ending Sep. 17, up 3.4% year-over-year, centered on Redfin. This pushed median monthly house payments to an all-time high of $2,661.

Dave Ramsey to the student loan personal debt inquiries: ‘It’s hard, but you are likely to have to face this’

Private money expert and cash loans in Orchard Mesa CO you may ‘The Ramsey Show’ machine Dave Ramsey meets ‘Fox & Friends’ to discuss Americans and then make ‘hardship’ withdrawals from their 401(K)s, education loan obligations and offers tips on how to boost cash.

The fresh Ramsey group bolstered the notion of sticking to a personal budget once the People in america enter the thicker of christmas.

“We would like to have the ability to say: okay, I will plan ahead, I’m not likely to let this sneak-up into myself,” Rachel Cruze, Ramsey economic pro, told you. “Therefore starting a budget, once again, is big in terms of that it… Therefore feel diligent and you will be sincere along with your household members and you can loved ones. Such as for example if rising prices provides strike you and you’re worn out which few days, best, otherwise next month at the end of the year, tell the truth about this and just state: hello, Christmas time looks some other.”

With regards to getaway purchasing, “America’s Industry Advisor” Ken Coleman stated an average U.S. household members spends between $800 in order to $1,five-hundred for each year.

“Just how throughout the while making a few more money? You got go out, and you will time form currency. So you check your current event and you will knowledge of your own works. How will you turn one to your freelancing money?” Coleman advised.

Americans haven’t sensed new full’ effect from high home loan cost: Gregory Faranello

AmeriVet Securities lead from You.S. rates Gregory Faranello into the Fed pausing price nature hikes, his mindset into markets in addition to UAW strike.

“This is basically the most well known top hustle in the usa now are freelancing,” he continued, “but there are genuine things like support service at night, you will find on the web tutoring operate, the individuals only to name a number of, to where you can generate one extra $800 in order to $1,five hundred ranging from now and you can Christmas to spend cash to own Xmas.”

“It can help you look at the currency and view, okay, here is what I get related to my currency, I have to enjoy christmas,” Warshaw told you. “However, I do want to put, with regards to christmas, I like to promote some one permission doing the least. Every person’s starting many and I am particularly, go small. You don’t need to have 50 events and you may 50 gifts. Take action brief or never do it whatsoever.”

Dave Ramsey: Emotional maturity’ is key getting economic health

Ramsey Possibilities President Dave Ramsey and you will psychological state pro Dr. John Delony argue whenever the heads embark on aware, they exchange just the right choice on fastest one.

Now, there is certainly a keen “stressed generation” regarding cost management and you will homeownership, Ramsey’s mental health pro John Delony warned.

“For people who check home loan costs, you appear in the student loans coming-on, i look at personal credit card debt, our company is nervous, nervous, nervous,” Delony said. “An effective present we could give to the high school students isnt way more articles.”