If you find yourself falling at the rear of on your payments or anxiety your might, contact their financial instantly. Westend61/Getty Photos

- Addition

- Exactly how mortgage non-payments functions

- Factors and effects away from loan standard

- How to prevent financing standard

Associate backlinks to the things on this page are from lovers one make up all of us (find all of our advertiser disclosure with our list of lovers for much more details). Although not, our opinions is our own. See how we rates personal loans to type objective critiques.

- Defaulting into financing goes when you skip money getting an effective put period.

- When you default on the that loan, your credit rating will suffer.

- With respect to the loan type, lenders can also be repossess equity or rating cost through other possibilities.

Introduction

You really have removed a loan to finance several off sales – for-instance, a installment loans online Missouri house, a car, otherwise your degree. But not, for folks who fall behind in your costs, the loan could go into the default, that will come with some big outcomes.

Definition of financing standard

Defaulting toward a loan is when you miss money for good certain quantity of your energy. This means, failing continually to maintain their avoid out-of that loan agreement can be sooner push the loan into the default.

Defaulting on financing can damage your credit rating rather, charge a fee plenty inside the gathered notice, and steer clear of you against bringing a unique loan in the future.

For those who standard toward a secured financing, the lending company possess the legal right to repossess the collateral. Such, for many who standard on your home loan repayments, the financial institution can foreclose on the family. For individuals who default to your personal debt, the lending company try not to quickly allege your own possessions. But not, the financial institution is also pursue legal action to obtain commission.

Difference in default and you will delinquency

Before you can theoretically default into the loan, there is certainly often an elegance months, titled delinquency, anywhere between shed a payment and you will defaulting toward loan. The duration of the newest delinquency several months varies based on your loan, nonetheless it commences whenever you skip a payment. According to the loan style of, which sophistication several months is normally on the range of 30 so you’re able to 90 days.

How mortgage defaults work

Because specific amount of days may vary with respect to the particular regarding financing and lender, we offer your loan to fall towards standard once you have missed repayments to have a-flat months.

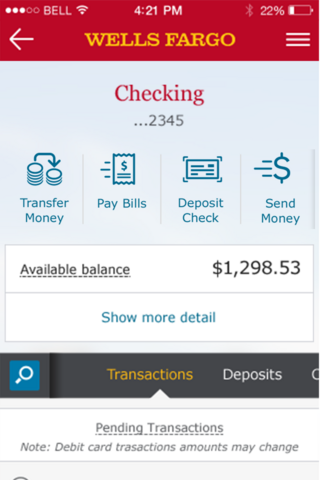

While falling at the rear of in your payments otherwise anxiety your you’ll, reach out to your financial instantly. Inquire about deferment choices, which cover a temporary stop into payment debt to have a great set several months. Actually a short reprieve you will give you plenty of time to score right back on track along with your financing payments.

In the event your bank cannot offer a beneficial deferment, this is how enough time you’ve got before you can are in default. Definitely, this new wide variety from the graph below are merely estimates. If you would like truth, get in touch with the bank to raised learn their laws and regulations.

Short suggestion: The particular timeline from defaulting on the that loan can vary situated into financial. When you have questions regarding the loan, look for explanation regarding bank.

Grounds and effects off mortgage standard

The type of mortgage your default into includes other consequences. Depending on the sort of loan, you have got your investment returns garnished, guarantee seized, or household foreclosed abreast of. As your default several months offers aside, it is possible to dish right up thousands of dollars in unpaid focus.

“Extremely mortgage arrangements to possess residential property and you may vehicle plus allow for the new actual repossession of the property when your personal debt is actually standard,” states Todd Christensen, a keen AFCPE-Licensed Financial Counselor. “While the loan providers cannot generally must repossess the car or foreclose in your house, they will start such procedures if they getting it is their the very least terrible solution.”