If you’ve possessed your residence for over 5 years, then you’ve got most likely benefitted out of an astounding increase in the worth. Out of just 2017 to 2022, U.S. home prices flower from the an astounding 40%.

Because of this, American property owners like you are in reality looking at over $twenty-eight trillion bucks out-of equity. And lots of try definitely trying utilize one newfound riches. In reality, we’re currently in the exact middle of a home guarantee mortgage growth.

Also it produces overall experience. Home equity fund promote more information on benefits. You can use the newest proceeds for pretty much something. This could were paying down college loans, coating scientific, dental or knowledge expenses, otherwise removing high-appeal bank card stability. It’s got a powerful way to lower your financial obligation.

You can also make use of the funds to build a separate addition otherwise over property update endeavor. If the spent on updates such as these, your house equity mortgage could actually help you improve the worth in your home.

Very, when you yourself have a list of high-measure plans otherwise bills you’ve been desire to address, you might be considering property equity loan due to VACU. You can expect a few higher choices to tap into the residence’s guarantee. The question is: And therefore choice would-be best for you? Let’s speak about for more information.

Just how can home guarantee choices work?

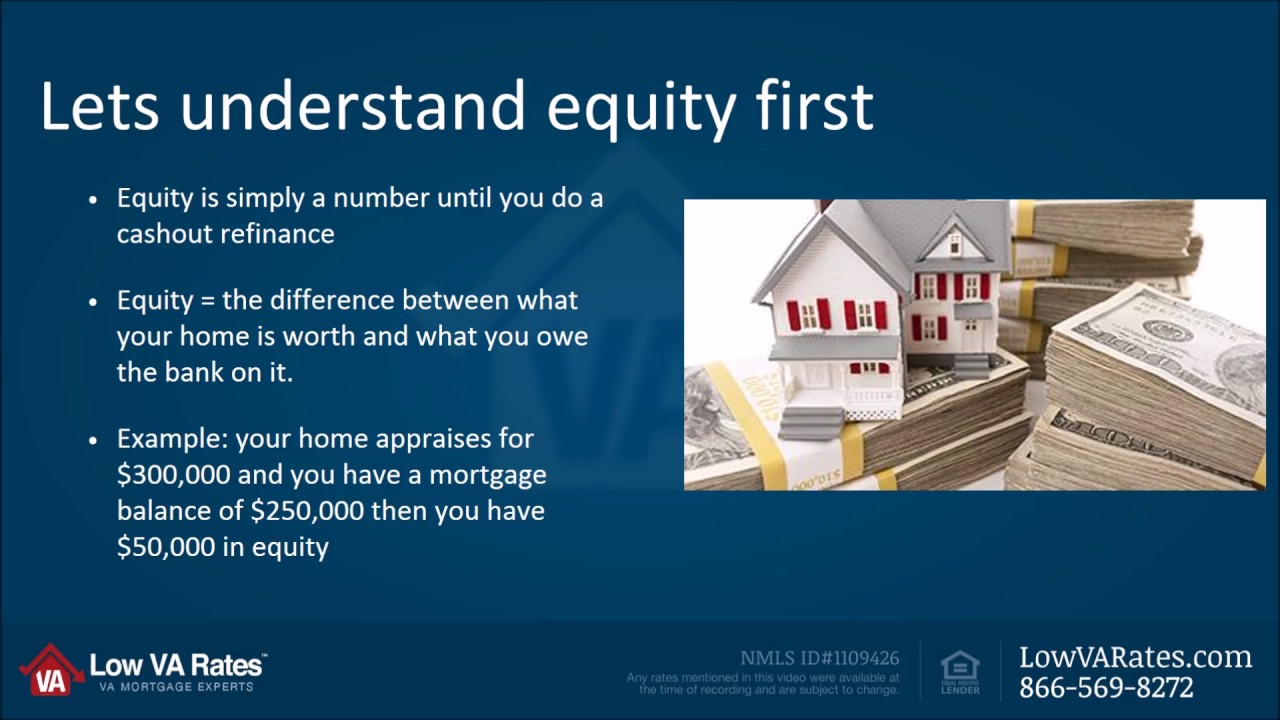

Also known as a good next financial, a home guarantee loan enables you to borrow cash making use of the guarantee of your property as the guarantee. Guarantee ‘s the number your home is already really worth, without any quantity of one existing home loan at your residence.

As opposed to a home mortgage refinance loan, home equity financing allow you to power an element of the worth of your house, in place of taking out a unique loan to restore the whole first-mortgage.

As the household collateral money was safeguarded from the property you possess, he or she is regarded as down risk. Which usually usually means interest levels which might be lower than unsecured expense including credit cards otherwise unsecured loans.

And since the brand new installment agenda is more than a lengthier time, home collateral fund make borrowing from the bank large number more straightforward to pay.

That will are better for you a property guarantee mortgage otherwise personal line of credit?

During the VACU, we provide one another a lump sum home collateral mortgage and you may a rotating domestic security personal line of credit (also known as an effective HELOC). Each other provide collection of variations and professionals.

Your choice of loan kind of will likely confidence lots away from details, as well as your a lot of time-label requirements, your short-label requires, plus individual issues. Why don’t we comment each alternative so you can evaluate.

What is a property guarantee mortgage and exactly how you are going to it help you?

A home collateral mortgage will provide you with the complete level of the borrowed funds in a single bucks payment. This number have to up coming getting repaid on a daily basis more than a pre-put amount of time. The attention towards complete amount borrowed would-be energized after obtain the newest continues.

Family collateral fund are to have big systems or expenditures instance a major household building work. A few of the significant gurus include:

- A predetermined monthly payment

- A predetermined monthly interest

- The capability to get better cost if you choose automated transfer out of your bank account

What’s a property collateral line of credit and just how you will definitely they help you?

VACU’s family security credit line (HELOC) makes you obtain, invest, and pay back because you wade, making use of your household because the guarantee. Generally, you could use up to a designated portion of your own total collateral.

Instead of all of our lump-sum home guarantee loans, an excellent HELOC offers use of a great rotating personal line of credit because the financing is approved. You may then feel the independence to utilize as much off the recognized borrowing limit as you wish, and you can only pay attention into matter that you play with.

VACU’s https://paydayloansconnecticut.com/poquonock-bridge/ family equity personal lines of credit offer self-reliance with continual expenditures, and additionally house renovations otherwise degree-associated will cost you. A few of the significant has actually and you will advantages include:

- An adjustable monthly payment

- A variable monthly interest

Just what are various other benefits of VACU’s domestic equity selection?

- Zero closing costs.

- Fund are used for whatever mission you like, along with do it yourself, knowledge costs, debt consolidating, unexpected costs, and much more.

- You might obtain as much as 90% of the appraised property value your property, with no amount of your home loan or any other liens.

- The very least borrowing number of $20,000.

How can you choose which choice is best for you?

Look at the chart below to look at and that family security option makes it possible to achieve your specifications. Inquire a few pre-determined questions to decide and this solution might be effectively for you. Is the expenses you are looking to pay for a-one-date costs including merging obligations or recurring eg college tuition otherwise home improvement programs? Can you favor a monthly payment that’s fixed or which is mainly based about how exactly far you’ve lent?

Submit an application for a great VACU Family Guarantee Financing otherwise HELOC

If you are searching towards the cash to fund numerous major costs on your own future, after that property security mortgage or HELOC of VACU might be an ideal solution. All of our of use downline is also respond to more of your private inquiries and help your know if your be considered.