- traditional loans from banks

- tough money loans

- private money fund

- scraping family equity

Let’s take a closer look at each and every to raised learn which type of financing are working perfect for disregard the property.

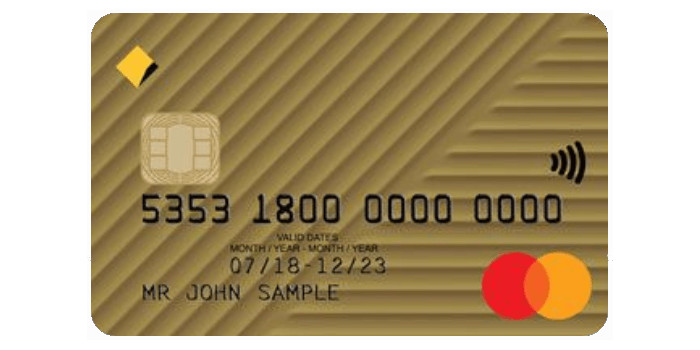

1. Conventional loans from banks

Old-fashioned bank loans adhere to guidelines put because of the Freddie Mac and you may Fannie mae. Such financing aren’t backed by the federal government than it is so you can FHA, Va, and you may USDA financing.

The quality expectation having a down payment into the a conventional bank financing are 20% of your cost of the home. Having funding services, loan providers usually require a thirty% downpayment.

- credit rating

- credit score

- income

- assets

These circumstances will help lenders influence their eligibility also your own rate of interest. Might show whenever you can manage your mortgage and you can the brand new monthly mortgage money for the investment property.

Remember that your future rental money are not factored on financial obligation-to-money (DTI) proportion. In reality, most loan providers assume one to has actually 6 months of cash place out to fund your investment assets mortgage financial obligation.

2. Hard currency financing

Tough currency fund are quick-name money which can be good if you want to flip an money spent in lieu of buy it to rent otherwise make. Difficult money fund are easier to qualify for than conventional loans. The focus out-of difficult money fund ‘s the house’s profitability, regardless of if your own lender often nevertheless envision things like your income and your borrowing from the bank.

To determine should you be able to pay-off the fresh new mortgage, the fresh new property’s projected once-fix really worth (ARV) is determined. That upside off tough money fund is that you could get financing money from inside the months in lieu of weeks or weeks.

Whenever you are these types of loans shall be more straightforward to safe and so are best to have household turning, the newest downside would be the fact rates can be higher since the 18%. Then there are less time to invest it right back. Extremely common for difficult currency loans to have terminology you to past lower than you to definitely yearpared to help you old-fashioned fund, hard money fund have large origination charges and you will closing costs.

step three. Private money money

An exclusive money mortgage is a loan from 1 individual a different, always anywhere between household members otherwise members of the family. In the event that neither of them are a choice for a personal currency financing, you may make the most of likely to local owning a home network occurrences.

The mortgage conditions on individual currency financing can vary since they try dependent on the relationship between your financial and the borrower. This type of fund is actually safeguarded by a legal offer enabling the fresh new bank in order to foreclose on family in the event your borrower defaults into the payments.

It is very important consider the relationships you’ve got for the financial before signing a binding agreement- particularly if you try fresh to a residential property investing.

cuatro. Scraping home guarantee

Another way to secure a residential property is by tapping https://paydayloancolorado.net/kirk/ the house security. You can acquire around 80% of home’s security worth to simply help pay for an investment assets. Faucet house collateral alternatives through the adopting the:

However, playing with security to finance disregard the assets can have the cons. Eg, if you utilize a good HELOC, you borrow against the latest equity as you carry out which have a cards card. Consequently your monthly payments will cover only the attention. However, the interest rate is commonly variable, meaning it can go up should your primary rates varies.

Try investment services beneficial?

At first glance, it might certainly look like financial support qualities are worth they. But just like any major choice from inside the a home, it is great for weigh the pros and downsides. Take advice from an informed throughout the home loan world prior to deciding.