When you find yourself later in your mortgage repayments, extremely mortgage contracts allow the bank so you’re able to charge late charges, possessions inspections, foreclosures will set you back, or other charge for your requirements not as much as certain affairs. The borrowed funds servicer, the organization one handles your loan’s time-to-big date government for the lender or latest mortgage proprietor (named a keen “investor”), tend to charge the fresh new fees for your requirements.

Once you have defaulted towards the loan together with servicer charge some other form of charge to your account, your mortgage loans will increase-often of the a significant.

Late Charge

In case the mortgage payment is actually later, the servicer will most likely charge a late payment given that grace period closes. Really financing agreements were an elegance age ten or ten days, immediately after which the latest servicer analyzes the cost.

The fresh servicer can charge later fees merely about count subscribed clearly of the home loan files. Discover the brand new later fee provision throughout the promissory mention your finalized once you got from mortgage.

Fundamentally, this new later fee have been around in an expense equivalent to five otherwise five per cent of the delinquent payment. In the event, state rules might reduce late charges.

Later https://paydayloancolorado.net/berkley/ costs can certainly stack up, adding hundreds of dollars toward matter your debt the borrowed funds manager (called the “lender” in this article).

Assets Examination Charges

Really mortgage and you may deed off believe deals ban brand new debtor out-of destroying otherwise breaking the domestic otherwise allowing the house or property to help you weaken. Loan agreements along with usually permit the financial when planning on taking required methods to protect its need for the home, including performing turf repairs, restoring damaged windows, otherwise winterizing an abandoned household (pick lower than).

As mortgage goes into default, brand new servicer commonly order push-by the property monitors so that the property are filled and you can correctly maintained. This new servicer up coming adds this new assessment fees to your complete home loan debt.

The total amount billed each examination is typically limited around $ten otherwise $fifteen. But inspections will be did monthly or higher usually, and so the charge accumulates.

Some process of law found one regular monitors commonly required if the servicer is actually contact with the new resident, understands the property is actually occupied, and contains you don’t need to bother about new house’s condition.

“Broker’s rate viewpoints” (BPOs) is property valuations you to real estate brokers or any other licensed individuals conduct after a borrower non-payments into loan. The new valuation depends into the personal investigation supplies, a force-of the external test, and you can recent similar conversion.

BPOs is actually a substitute for the full appraisal and you will, such as for example assets checks, are purchased to evaluate new mortgaged property’s health and cost. BPOs cost more than drive-by inspections, usually as much as $100, indeed less than the full assessment, which costs several hundred or so cash.

Assets Maintenance Can cost you

The loan servicer may additionally costs the expense to own retaining the newest property’s worthy of towards the borrower’s account. A house conservation company otherwise “occupation functions providers” that the servicer employs constantly handles the maintenance.

- capturing so you’re able to file the condition of the house or property

- securing a clear property from the replacement hair

- lawn care or accumulated snow reduction

- fixing injury to the house or property

- winterizing an empty possessions, and you will

- removing scrap, debris, otherwise quit personal property.

Are collectable throughout the debtor, the house or property maintenance charge energized must be in fact sustained and expected to preserve the fresh property’s value or the lender’s legal rights on property.

Foreclosures Fees and you will Can cost you

Individuals are generally necessary to spend the money for lender’s charge and you can will cost you from the a foreclosure. The latest servicer can add on this type of sums toward total mortgage harmony.

Attorneys’ Charge otherwise Trustee’s Costs

Legal counsel generally protects a judicial property foreclosure, since alternative party that always takes care of a great nonjudicial foreclosures is titled a “trustee.” To get collectable, attorneys’ fees or trustee’s fees should be practical as well as incurred.

Foreclosures Will set you back

- label costs

- submitting costs

- tape fees

Non-Enough Money Percentage

A non-adequate funds commission (called a good “returned fee percentage” or “returned glance at payment”) are charged so you’re able to a beneficial borrower’s membership when home financing commission will come of a closed account otherwise a merchant account that will not features enough finance so you’re able to award the fresh new commission. This commission always range out of $fifteen so you can $75 and will feel limited by county rules.

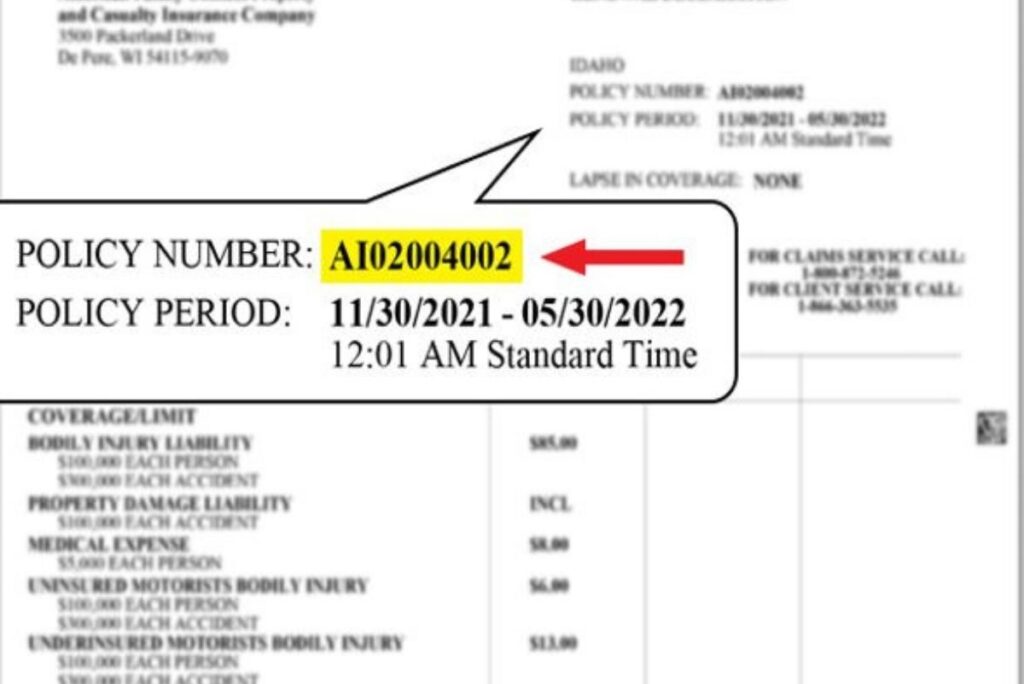

Force-Placed (otherwise “Lender-Placed”) Insurance coverage

Really mortgages and you can deeds off faith wanted that the resident take care of homeowners’ insurance to safeguard this new lender’s demand for matter of flame or another casualty. If for example the resident doesn’t look after continuous insurance rates, the financial institution can get purchase insurance rates and charges they on borrower’s membership. This sort of insurance is named “fotherwisece-placed” (or “lender-placed”) insurance rates.

The fresh servicer need certainly to send next find about 30 days following basic notice. In case your citizen doesn’t give evidence of insurance within this fifteen months following next notice, the latest servicer normally place the insurance coverage. An excellent servicer need certainly to cancel the lending company-put publicity within this 15 months just after acquiring evidence of exposure and refund any backup visibility costs.

Lender-put insurance is normally high priced. It will prevent a borrower who may have currently having trouble and make money away from catching up because it usually leads to a big improve when you look at the monthly installments.

Suppose your loan servicer improperly orders insurance policies once you currently got established publicity. Therefore, you’ve probably a security to help you a foreclosure, particularly if the more costs triggered that standard toward loan.

Corporate Advances or other Costs

Business enhances is actually expenditures brand new servicer paid down that will be recoverable out-of brand new borrower. Allowable advances might is case of bankruptcy charges, as an instance. Just after a debtor files having bankruptcy, new servicer you’ll sustain attorneys’ fees and will set you back included in the brand new bankruptcy process.

A servicer may additionally charge immediately delivery charge and other charge in a few facts, such when an excellent reinstatement otherwise benefits declaration is ready and you can sent to the borrower or another subscribed people.

If undefined corporate advances show up on your bank account, you will want to pose a question to your loan servicer having an explanation to be sure these are typically right for introduction throughout the full amount you borrowed from.

Hiring a property foreclosure Attorney

In case the financing servicer charges incorrect otherwise a lot of charge to the account, you could potentially complications those individuals charges just before or throughout a property foreclosure. Consider talking-to a foreclosures lawyer that will help you to the what direction to go on the kind of problem.