When getting a good Virtual assistant Mortgage, you will possibly not be aware that you would not in most cases feel stuck on additional cost out-of Private Financial Insurance policies (PMI). Thankfully, among the high benefits associated with Virtual assistant fund ‘s the absence away from PMI. As you move through the article there should be particular tall money-saving information, but also it is best to see for every element of your financing.

Why don’t we be at liberty to describe why information PMI is so important as well as how it does not just cost you money in the event the that you don’t understand it, however, furthermore could save you a lot of money given that you create choices about what tool you employ to find an effective this new property.

Many score confused when they are trying to play with their Virtual assistant financing for another otherwise 3rd some time try actually experienced to believe new Virtual assistant financing commission and you may PMI is equal points. This is simply not the actual situation.

I would like to easily express how to the a primary family pick I happened to be well educated on this point because of the my personal unbelievable lender and how the financial institution stored many, the if https://paydayloancolorado.net/greenwood-village/ you’re simply putting off 5% back at my antique mortgage!

- Closed my personal get in touch with toward property

- My personal lender and i also had the interest rate closed in the

- We went the amounts in the adopting the issues (5%, 10%, 20% down)

- I decided I wanted to try to remain as much cash in my own hands (as I needed to invest in more expenditures!)

- Up coming dialogue my financial ideal to reduce the brand new percentage one to perform normally have PMI to have a traditional which have below 20% down we would like to research rates getting PMI rules.

- I added upwards exactly what the recover day would be with the $100 PMI commission thirty day period up to 20% are reduced, so you can simply how much a lump sum payment policy is, ($3200 in closing). It actually was planning capture extended to make it to an excellent 20% paid down number so when I did new recoup go out We knew immediately after 32 weeks out of $100 costs I would enter the latest environmentally friendly!

- I got myself brand new lump sum Personal Financial Insurance policy therefore are set in my personal closing costs. Overall as the I’ll own the house for over thirty-two days monthly over the earliest thirty-two days I am making a profit out-of me personally even if the mortgage is not from the a great 20% paid down amount!

This is not a well advertised technique for doing business however, its value inquiring the financial in the because the based what sorts of loan you are able to learning how each of them works is key!

Now we are going to dive for the really understanding the concepts regarding just what Personal Mortgage Insurance is and just how it functions or is non existent with the Virtual assistant mortgage usually!

What’s Personal Financial Insurance policies?

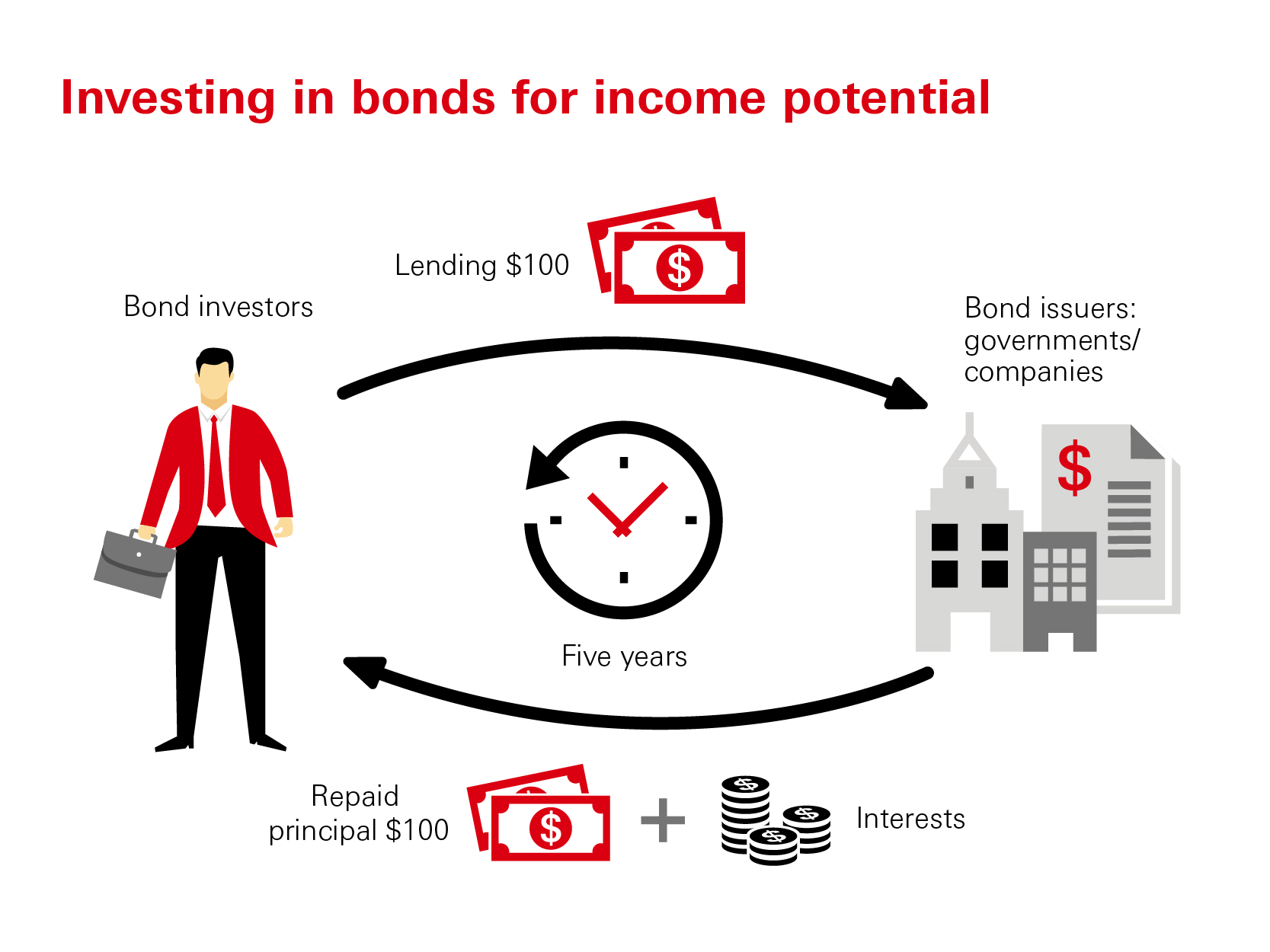

Private Financial Insurance rates, popularly known as PMI, is a kind of insurance rates you to old-fashioned lenders wanted off borrowers whom do not build good 20% down-payment. It protects the financial institution if the debtor defaults on the mortgage.

PMI and exactly why You pay They (Sometimes)

PMI can often be an importance of old-fashioned mortgage brokers where in actuality the debtor try struggling to meet the standard 20% down payment. Generally, it’s a safety net to own lenders it ensures they won’t generate losses when your debtor are unable to make mortgage payments. Lenders the has actually different ways to possess borrowers to fund which equipment. Instance i talked about a lot more than particular loan providers require a monthly payment and some will allow lump sum payment payments towards the policy upfront. Starting the fresh new mathematics together with your lender is essential observe which mode you should check out investing!