Your earnings enhanced

Congratulations! You’ve got a publicity otherwise come an alternate business, that has increased the amount of money you will get in your wages. This is an exciting go out, thus having fun with a home loan calculator observe how you can reduce the word of borrowing from the bank will come having waves out-of joy. Calculators will teach one to plumping enhance repayments from the also a beneficial small amount can cut weeks or ages off the label out-of your loan. High costs imply smaller appeal and principal any time you generate a home loan installment.

Team going gangbusters

Jake and Tom are one another life and you may company people, as well as their company is booming. In two decades, their earnings provides twofold and there try contracts reaching into upcoming. Jake and you will Tom very own a house together, that they purchased five years ago. Back then, they might hardly scratch a deposit together, so that they chosen a thirty-year mortgage title to save repayments low. They’ll communicate with its existing lender, along with several various other banking institutions. Because the companies, Jake and you can Tom is savvy; they are going to drive an arduous offer and choose the solution which is really beneficial.

You have had good windfall

Possibly a family member bequeathed you a neat amount of money. Or if you marketed a business, assets otherwise a greatly valuable distinct ways/stamps/bitcoin. Or it may be your received a bonus otherwise had lucky’ during the Lottery. No matter what need, a windfall is going to be renowned and you can put wisely. Repaying an amount of your own financial is good idea. You have the accessibility to cracking out of with your financial otherwise which have a speak to your existing lender (make sure to find out about any break charges or split will set you back). The newest lump sum payment usually reduce the phrase of your own loan, thus you’re going to be financial obligation-100 % free in the course of time.

Anyone desires display your debt

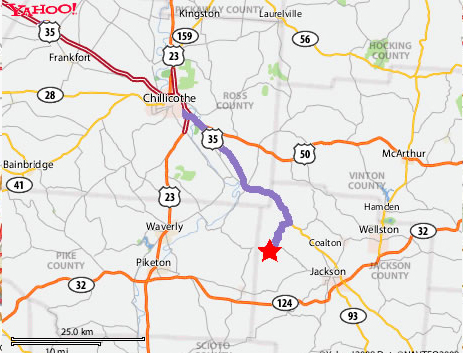

Perchance you discover your own forever spouse, had a sibling/mother move around in along with you otherwise need to broke up a house that have a buddy. Whatever the story, when someone else desires join the mortgage, and you also thought it is better, you may be capable raise your payments. Your home loan friend might even possess a lump sum to take off the loan’s dominant. installment loans no bank account Delta Using this improvement in circumstances, you could re-finance your home loan or restructure to a mutual mortgage. It is a time for you research rates for a unique financial and you will difficulty your lender so you’re able to step up which have a give.

Flatmates become lifestyle people

Whenever Harry moved into the Hazel’s household due to the fact a great flatmate, they easily turned close friends. Then they truly became more than family unit members. 2 yrs after, Harry and Hazel chose to enter wedlock financially, by moving to a provided mortgage. Luckily, brand new fixed home loan to own Hazel’s family was only coming up having restoration. Thirty day period before rollover time, Harry and you may Hazel spoke with the present financial about their monetary condition and you may another loan. Their bundle will be to place the house on the each other their brands, pay a lump sum payment off (Harry’s offers) and you will shorten the loan identity.

Costs associated with refinancing

If you find yourself refinancing otherwise restructuring their mortgage will save you currency, you will find likely to be charge on the procedure, especially if you happen to be using a totally new bank otherwise lender.

- Break costs you have a mortgage agreement set up together with your lender that will have had you paying interest to the loan in the tomorrow. So you can refinance, you might be breaking it arrangement to begin with another, which means that your newest lender loses you to definitely anticipate revenue. The fresh Zealand legislation means banks to incorporate a choice for fixed speed contracts become damaged, in addition to lets these to ask you for to recoup will cost you. To ascertain just what break charges otherwise break can cost you would be in it for the problem, speak to your most recent bank or lender.