Windsor Ridge House hosts an open home on the model domestic within their the community Lorson Farm, Colorado Springs, Colo., . Veterans Circumstances employs assessors and appraisers to ensure that per household ordered from the services members was valued precisely. (U.S. Army photographs of the Sgt. Eric Glassey, fourth Inf. Div. PAO)

New Department out-of Experts Facts financial system has been used of the scores of solution members and pros whilst took figure around the end regarding The second world war. It is probably one of the most popular professionals to have experts: Loan providers granted eight hundred,692 Virtual assistant-supported loans totaling almost $145 million within the 2023, which have the typical loan amount out-of $360,863, with respect to the Virtual assistant.

The basics

The latest Va doesn’t matter the new loans themselves, but backs funds granted by the financial institutions. The brand new Virtual assistant pledges a percentage of an eligible beneficiary’s mortgage to get or re-finance property, making it possible for the lending company to incorporate most readily useful, less expensive conditions and sometimes enabling the latest Illinois personal funding loans borrower close the offer without a huge dollars-downpayment.

Qualified provider participants and you can pros can use to have domestic-purchase finance via individual-sector loan providers. There aren’t any Virtual assistant loan constraints for experts with the fresh full entitlement. For good Va-recognized financial, you’ll still have to satisfy your own lender’s borrowing and earnings loan standards to help you found investment. These types of Va home buy financing can be used to get manufactured residential property or house under design, oftentimes, although not cellular home.

An interest rate Reduction Refinance loan might possibly lose the rate for the a current Va-backed loan, or tends to make new money even more steady of the swinging out-of an varying otherwise adjustable rate of interest so you’re able to a predetermined speed.

Virtual assistant money come with costs that vary because of the loan particular and you may veteran reputation. Veterans utilizing the benefit the very first time into a no-down-fee get loan shell out a two.15% commission, eg, if you find yourself a seasoned while making one minute dollars-out refinance mortgage carry out pay a 3.3% commission. The full fee dining table can be obtained through the Va.

Veterans which located otherwise qualify getting Va disability settlement, Red-colored Cardio users and you can certain anyone else try exempt from charge. Most other money – as well as mutual loans, structure finance and financing to afford price of energy-productive solutions – is supported by the fresh Virtual assistant. Consult your bank to learn more.

Qualifications

Virtual assistant financing eligibility cannot end, though the entitlement are only able to be taken to the borrower’s lay of household (not a rental assets). It could be reinstated following the mortgage is paid down otherwise less than almost every other affairs – an alternate veteran normally suppose the mortgage, as an example.

Whether or not latest or former soldiers are eligible having Virtual assistant money is based how enough time it offered and in and this decades.

Old experts qualify for Virtual assistant money whenever they supported to your active obligations for at least ninety days within these dates:

- Sept. 16, 1940July twenty five, 1947

- Summer twenty seven, 1950The month of january. 29, 1955

- Aug. 5, 1964May 7, 1975 (initiate )

If the another person’s solution fell external those people big date range, they may you would like 181 persisted months into energetic duty to help you qualify. Filled with enlisted soldiers whom split to the or just before Sept. 7, 1980, and you can officers just who separated towards the otherwise ahead of October. 16, 1981.

If the a person’s provider appeared following the over go out range, needed 2 years of your energy into the effective responsibility – otherwise shorter for certain discharges.

Getting mortgage objectives, Va considers Gulf coast of florida Battle provider to perform Aug. dos, 1990 by way of twenty-first century. Services members out-of that point months need finished 24 months off proceeded effective-obligations solution getting eligible, or perhaps 90 days for certain release statuses.

Troops who will be currently on active obligations getting eligible for an effective Va loan immediately after ninety days of provider, provided it are active. Qualifications today comes with Federal Guard and you can Reserve members with no less than ninety days out-of energetic provider. Soldiers discharged for an assistance-connected handicap qualify, no matter solution size.

Property foreclosure advice

When the a great Virtual assistant-secured loan gets outstanding, Virtual assistant works closely with the newest debtor to avoid property foreclosure, and additionally taking financial guidance. In many cases, that involves direct input with a mortgage loan servicer on the debtor.

In 2023, the brand new Virtual assistant aided more than 145,000 Va borrowers continue their homes. See a long list of family-mortgage assistance at Va.

Step activities

The main action getting solution players and you can experts is to find a certificate out-of Qualifications, often from eBenefits website or through their financial, to-be entitled to a great Virtual assistant-backed mortgage.

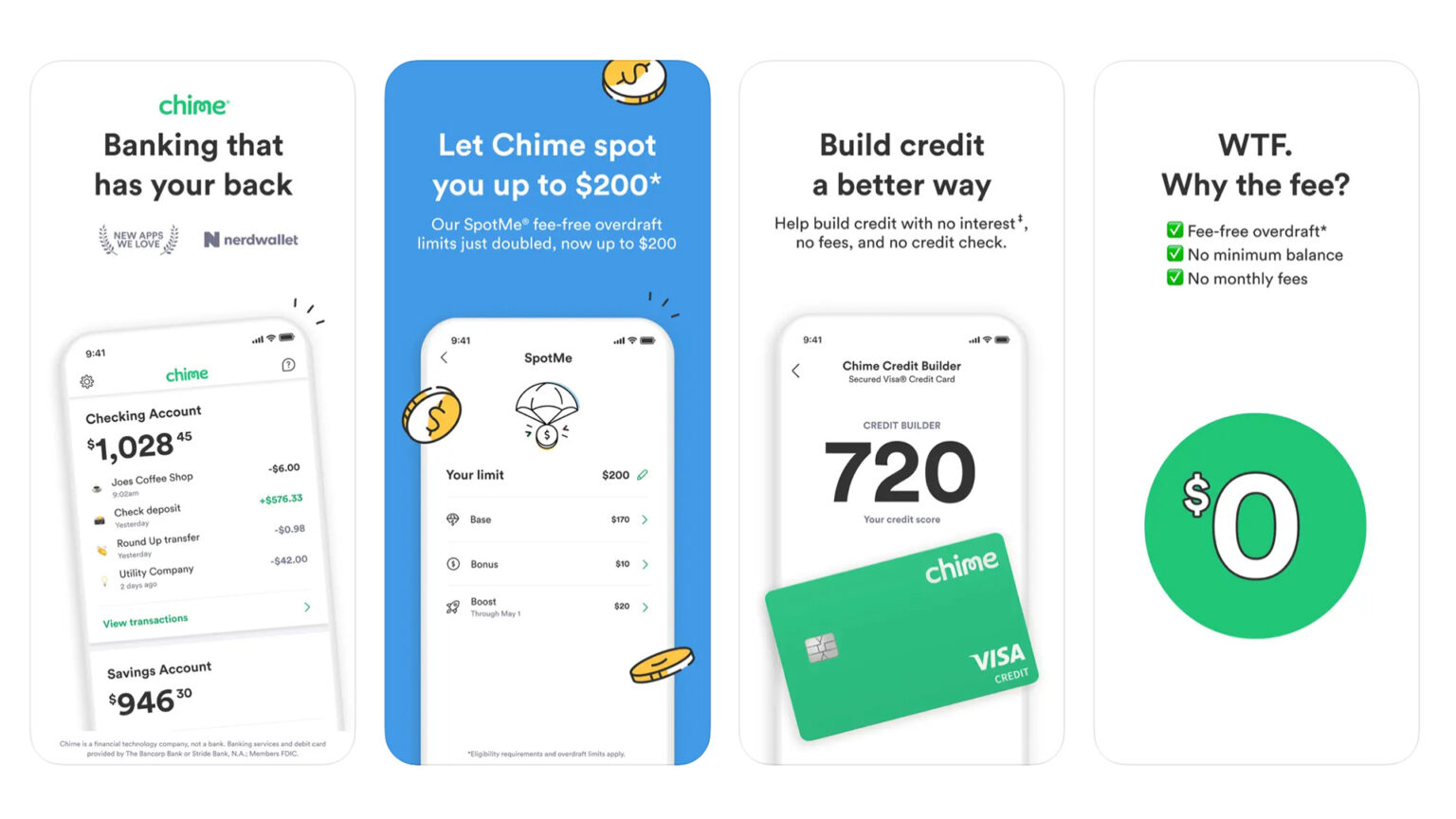

People seeking to refinance established financing is always to read lenders’ ads issue carefully: Va and Consumer Economic Coverage Bureau has actually warned out of ong new red flags was competitive conversion process strategies, low interest rates having unspecified terms, and you may pledges that individuals can forget a mortgage commission as a key part of this new financing – a practice prohibited by Virtual assistant.

Certain veterans have observed problem in making use of the Va loan work for, especially in competitive casing places in which numerous estimates are produced to your property. Virtual assistant authorities have said one misperceptions nonetheless persevere certainly suppliers and you can representatives you to Va capital is less trendy than just traditional funds. Those in a has best if pros question their actual auctions and lenders about their feel and just how will they usually have aided pros explore the Va financing work with.

What is actually the fresh new

Pros nonetheless struggle to make mortgage payments. Virtual assistant keeps highly recommended an effective moratorium to the property foreclosure because of because they manage financing servicers to get possibilities. Brand new moratorium will not apply at bare otherwise quit properties.

Va is also extending the new COVID-19 Reimburse Amendment system because of is designed to let pros remain its land by permitting Virtual assistant to acquire element of its mortgage, doing a low-interest-influence next mortgage.