Experts Joined Prices and you may Charges

Experts United shares their latest Virtual assistant loan rates of interest to the its webpages. With respect to the current study, Veterans United’s costs is a little below or towards the par into the national mediocre for 30-year and you can 15-season repaired-rates Va finance.

Regrettably, Pros United cannot reveal the rates to possess low-Va financing, so it is hard to give how they accumulate to your competition. However, a lender’s mediocre rates aren’t always reflective of your own speed you are able to be offered. Locate a customized price price for the sort of financing from Veterans United, plus an excellent Virtual assistant financing, you’re going to have to glance at the pre-recognition procedure and accept a painful borrowing from the bank inquiry.

Providing numerous quotes is very important when shopping for a home loan. Indeed, according to a study by Freddie Mac, consumers exactly who seek no less than four quotes has an average annual deals out of $step 1,200. A different sort of data from the Government Set aside Bank out-of Philadelphia discovered that looking to one or more even more rate price causes an 18-basis-point rates cures and you may good twenty-eight-section cures to have down-earnings consumers.

And your loan interest rate, you will also shell out specific financing costs. Pros Joined charge a condo 1% origination payment towards the their financing, that’s into the top end regarding normal for the majority loan providers. If you are taking right out good Va loan, you will also have to pay a Va money payment, but that’s recharged from the Va instead of Pros United and will use no matter what lender your obtain off.

On the web Sense

Pros United’s web site is fairly easy to navigate. New pre-recognition procedure is simple and you can mind-explanatory. Possible see information including informative stuff, home loan calculators, the homebuying way, borrowing consulting recommendations, Virtual assistant financing cost, and much more.

For which you get have trouble with Experts United’s website is when you will be trying to get financing aside from a great Va mortgage. When you find yourself Veterans Joined has the benefit of old-fashioned money, FHA loans, and you may USDA finance, it generally does not create information regarding the individuals financing free for the its webpages, nor does it disclose interest levels to your those individuals financing.

Customer service

Among the many places where Pros Joined stands out try within the customer care. It has got 24/7 support service to suit their overseas consumers-this is exactly particularly important offered its work on Virtual assistant finance. You can get in touch with the firm via cell phone, email address, mail, otherwise certainly one of their individuals social network profiles.

Customer happiness

Veterans Joined has absolutely a great client satisfaction ratings. Earliest, the lending company has got the highest-ranking of every lender when you look at the J.D. Power’s 2023 You.S. Home loan Origination Pleasure Investigation. In addition, it have the common rating away from cuatro.9 out-of 5 celebs into Trustpilot. It has over eleven,000 recommendations and you may 96% of these was 5-superstar ratings.

Many recommendations praise the business’s sophisticated customer care plus the ease of the homebuying processes. But not, its really worth detailing that all ones analysis particularly resource Va loans-it’s hard to obtain recommendations from users that gotten almost every other financing models out of Veterans United.

Membership Government

After you personal on a home loan, loan providers may sell the mortgage to another loan servicer. Experts Joined will not divulge when it transmits or offers their funds to another servicer.

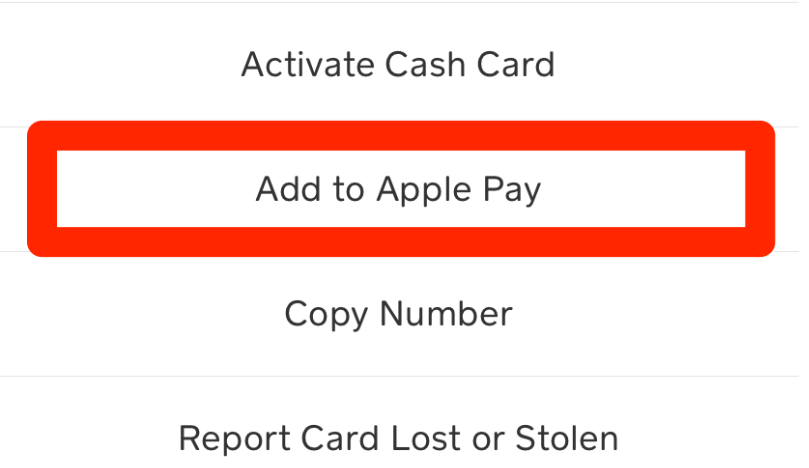

If the Experts Joined maintains your home mortgage, you can create they from your own on line membership or mobile app. Here, possible song and you can control your costs, as well as setting up automobile-pay.

Pros Joined is not the full-service financial institution, definition it doesn’t bring banking or other comparable monetary qualities. Although not, the firm does offer two most other associated functions.

Very first, Veterans United Realty are an affiliate mate of the lender. It’s a nationwide system $800 loan today Cedaredge CO out-of realtors regarding the U.S. you to concentrate on providing experts pick property. Individuals exactly who play with each other Veterans United Realty and you may Experts Joined House Funds can be qualified to receive particular offers on their settlement costs otherwise interest.