Be mindful on borrowing from your advancing years investment.

Whenever you are shielded under the Government Professionals Old-age Program, expenses as much of salary as you possibly can afford inside the fresh new Thrift Discounts Plan is essential so you’re able to guaranteeing a smooth senior years. And it’s really besides vital that you ensure you get your currency for the Tsp, however, to save they there.

After just last year, there were over a-quarter off so many an excellent Tsp fund, totaling regarding the $cuatro.5 billion. Once you obtain from the Teaspoon, the bucks happens of one’s balance within the proportional amounts of old-fashioned and you may Roth opportunities. Such as for example, when the 80% of membership is within the antique balance and you will 20% is within your Roth harmony, after americash loans St Augustine Shores that 80% of one’s matter your obtain could be out of your conventional balance and you can 20% might be from your Roth.

You are paying the mortgage back into your self that have appeal (calculated in the G Funds speed if financing is approved). But by the temporarily delivering currency from the account, you can easily miss out on some of the material money you could otherwise enjoys accrued.

Just what Not to ever Carry out With your Teaspoon Membership

You ought to start paying off the Teaspoon financing with appeal inside sixty times of if it’s disbursed for your requirements. Their payroll place of work begins subtracting loan money from the income for every single spend several months. Ensure these types of costs won’t allow you to reduce your new benefits and you can get rid of your below the 5% needed sum so you can receive the full department suits.

- You can easily spend a single-time percentage out of $50 getting a standard purpose loan or $100 percentage having a first household loan.

- At the time of ortized in order to an extended or smaller percentage period in the event that you’ve got gone to live in an agency which have an alternative pay course.

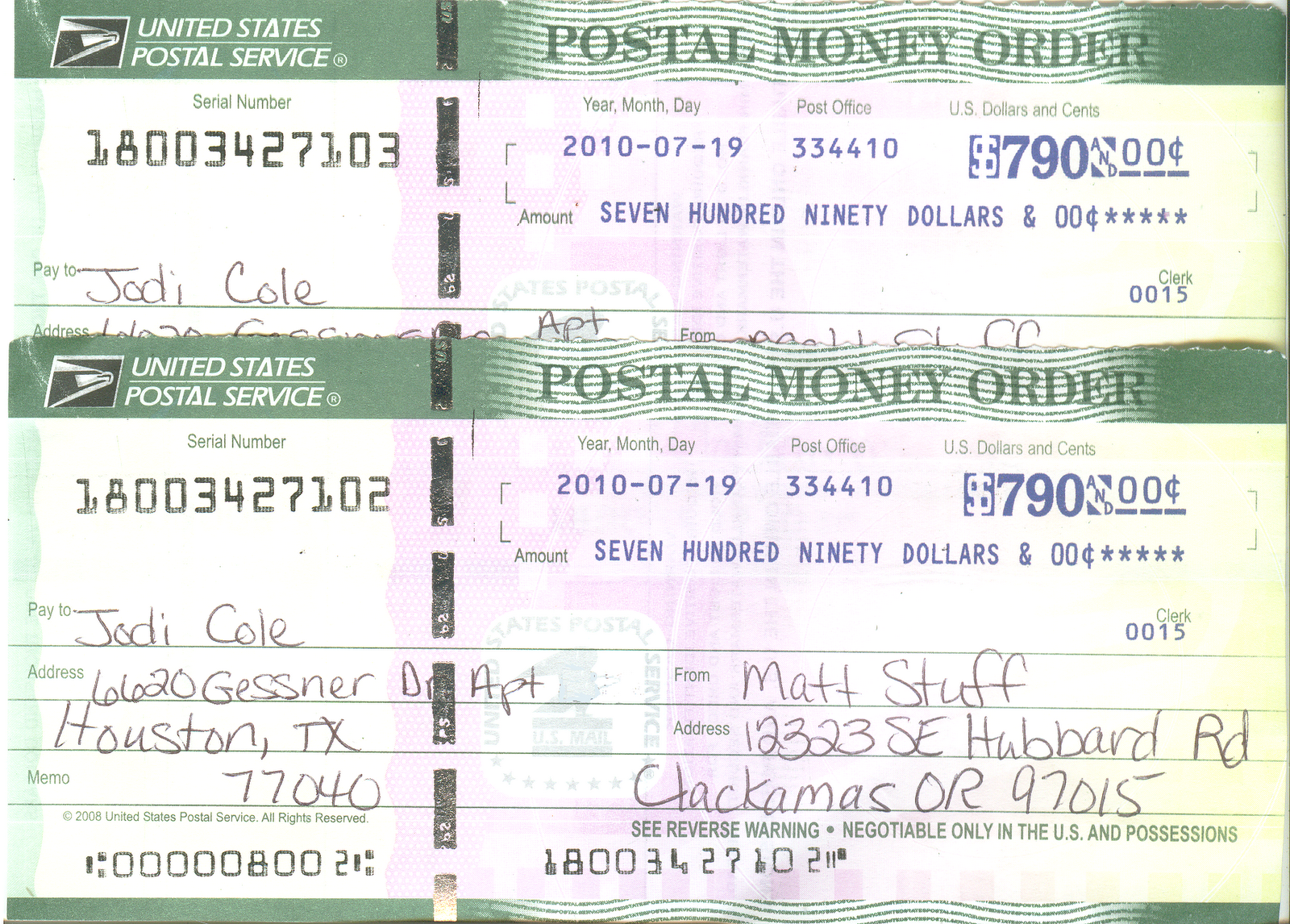

- You possibly can make loan costs as well as payroll deduction so you’re able to pay-off your loan more quickly or even make up for overlooked costs. You can do this of the direct debit a maximum of two minutes four weeks otherwise by look at or currency order any kind of time big date.

- An immediate put membership or mailing target need to be placed into your account about one week (excluding weekends and you will getaways) before you can fill out financing consult.

- Whenever making an application for a teaspoon financing, you need to confirm your own marital status. When you’re separated, you need to contact the new Tsp ThriftLine so you’re able to update your updates to help you single. A beneficial spousal signature is needed in case your Tsp account information nevertheless shows your own status just like the hitched.

- If you have a great loan once you separate off federal provider, you have around three options: Earliest, you could potentially pay the loan regarding. Or you can support the loan energetic from the setting up month-to-month repayments of the consider, currency purchase otherwise direct debit. The new terms of the borrowed funds do not change once you separate, and the maximum time-limit getting paying your loan however applies. In the end, you could potentially allow loan to be foreclosed and you will accept people nonexempt part of the outstanding equilibrium and you may accrued attract while the nonexempt money.

You can’t get yet another loan after you hop out the government. If your wanting to apply for a tsp mortgage, make sure to cautiously take a look at the Teaspoon booklet towards financing.

- Whilst the full dollar quantity of your own contributions to a traditional, pre-income tax Teaspoon membership gets into your account, your net gain ount. Simply because your benefits reduce your taxable earnings. It will be possible the state and federal tax withholding will go off when your Teaspoon contributions go up.

- For individuals who expect to getting investing increased income tax speed when you look at the old age than youre now (on account of highest earnings later in daily life otherwise changes in the fresh new tax laws and regulations), you might want to build after-income tax contributions in order to a great Roth Teaspoon account. These types of efforts does not reduce your most recent tax bill, but offers particular taxation-100 % free money later on in life.

- And make change towards the Tsp contributions, speak to your department payroll supplier.